| |

| ISD #881 - Maple Lake |

|

|

| How to use this web site tax calculator? |

|

|

Please enter the Parcel Identification Number from the County in the yellow box below and press the Get Info button to determine the estimated property tax impact for the November 7, 2017, ISD 881 referendum requests.

|

|

|

|

| |

Tax Calculator by Parcel - Allows User to Enter Parcels from from Wright County |

|

|

|

|

| Step 1 |

Find and Enter Parcel Identification Number |

|

|

Please enter the Parcel ID in the format indicated. If you need assistance locating your Parcel ID number, please use the following link:

|

|

| |

|

xxx-xxx-xxxxxx |

|

Look up Wright County Parcel Information |

|

| Step 2 |

Click the Get Info Button to see Estimated Tax Impact Below |

|

|

|

|

|

|

|

|

|

| Step 3 |

Calculation of Tax Impact |

|

|

| |

Estimated Market Value* |

$ 0 |

|

|

|

| |

Primary Property Owner |

|

|

|

|

| |

|

|

Annual |

Monthly |

|

| |

Operating Levy Question #1** |

|

$ 0.00 |

$ 0.00 |

|

| |

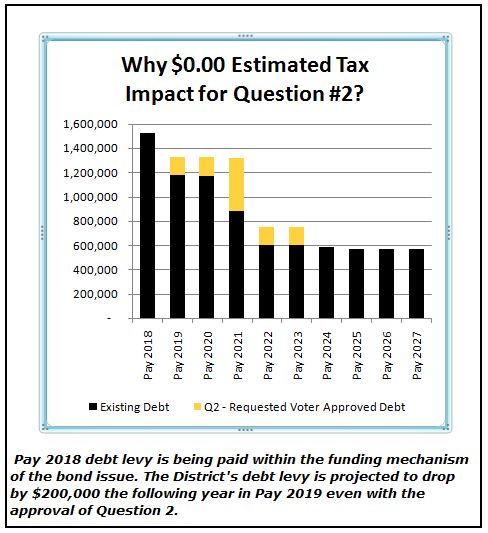

Bond Question #2 - See graph explanation for why $0.00 |

|

$ 0.00 |

$ 0.00 |

|

| |

Est. Change from Pay 2017 for Pay 2018 |

|

$ 0.00 |

$ 0.00 |

|

| |

Planned Pay 2019 Levy Reduction |

|

$ 0.00 |

$ 0.00 |

|

| |

Est. Change from Pay 2017 for Pay 2019 |

|

$ 0.00 |

$ 0.00 |

|

| |

|

|

* Value uses data finalized for taxes payable in 2017 for this tax impact analysis.

|

| |

|

|

** - Question #1 estimated tax impact includes estimated impact changes due to existing operating referendum, the impact of Question #1, changes to the long-term facilities maintenance levy, changes to the equity levy and, if applicable, the new Ag2School Tax Credit.

|

| |

|

|

If the tax impact does not show after clicking on Get Info button, please verify correct entry of Parcel ID #. If you continue to have problems,

please email Michael Hoheisel at mhoheisel@rwbaird.com with any questions.

|

| |

|

|

Estimated Tax Impact information prepared by Robert W. Baird & Co, Inc. using Parcel ID information obtained from the aforementioned County. |

| |

Page viewed 232 times. |

| |